Bond Valuation Problems and Solutions Pdf

It can arise either during the production or the consumption of a good or service. Distinctions Among Valuation Concepts 74 Bond Valuation 75 Preferred Stock Valuation 78 Common Stock Valuation 79 Rates of Return or Yields 83.

Pdf Exercise Session 2 Suggested Solutions Dmitry Bohatyrov Academia Edu

DUBAI United Arab Emirates Aug.

. 18 2022 GLOBE NEWSWIRE -- The global pixel pitch LED market is anticipated to reach a valuation of US 136 Bn in 2032 with sales growing at a stellar CAGR of. Abramson Algebra and Trigonometry ISBN 978-1-947172-10-4 Units 1-3 and Abramson Precalculus ISBN 978-1-947172-06-7 Unit 4 Responsible party. As per FMI the global eco-friendly paper plates market size is set to reach a valuation of US 18 Bn by 2032 and exhibit growth at a CAGR of 43 from 2022-2032.

In all cases any non-recoverable upfront expenditure related to this flexibility is the option premiumReal options are also commonly applied to stock valuation - see Business valuation Option pricing. 1241 Basic bond valuation formulas 427. PDF This book provides.

PDF On Jun 3 2020. There are several methods of appraisal for each of the business valuation approachesAsset Based Approach. The actual real options generically will relate to project size project timing and the operation of the project once established.

Boeing and Exxon 0 0 Practice Problems. The open interest of a futures contract at a particular time is the total number of long positions outstanding. Solution Manual Investment Analysis.

332 Required returns and risk aversion 76. Self-Correction Problems 37 Problems 37 Solutions to Self-Correction Problems 38 Selected References 39 l l l Part 2 Valuation 3 The Time Value of Money 41 Objectives 41. Bond valuation preferred stock valuation Common stock valuation Concept of yield and YTM.

M 305G Preparation for Calculus Syllabus. 1 Equity Valuation Lecture Notes 8 Contents About Valuation 2 2 Present-Values 2 3 Choice of the Appropriate Discount Rate 2 4 Future Cash Flows. Download Free PDF View PDF.

Adjusted Net Asset Value Method - This business valuation method requires that the appraiser adjust the assets and liabilities to the fair market value as of the date of the valuationFor example tangible assets such as machinery. Learn What EY Can Do For Your Corporate Finance Strategy. Distinguish between the terms open interest and trading volume.

Ad EYs Corporate Finance Services Can Help You to Manage Your RiskReturn Trade-Offs. A negative externality also called external cost or external diseconomy is an economic activity that imposes a negative effect on an unrelated third party. Ad EYs Corporate Finance Services Can Help You to Manage Your RiskReturn Trade-Offs.

Solutions Manual for Options Futures and Other Derivatives 10th Edition by Hull IBSN. The Dividend Discount Model DDM 3 5 The Two-Stage Dividend-Growth Model 5 6 Dividends and Earnings 5 7 The EVA Model 8 8 Alternative Valuation Techniques 9 9 Applications. Incorporated relevant numerical problems at the end of each chapter.

Amanda Hager December 2017 Prerequisite and degree relevance. An appropriate score on the mathematics placement examMathematics 305G and any college. Learn What EY Can Do For Your Corporate Finance Strategy.

Download Free PDF. Weight of peri formwork. Solution Manual Investment Analysis Portfolio Management THE INVESTMENT SETTING Answers to Questions.

The market is anticipated to be. MARKET FLASH Problems with negative interest rates 75. Better source needed Pollution is termed an externality because it imposes costs on people who are external to the producer and.

The flexibility available to management ie.

Bond Valuation Formula Steps Examples Video Lesson Transcript Study Com

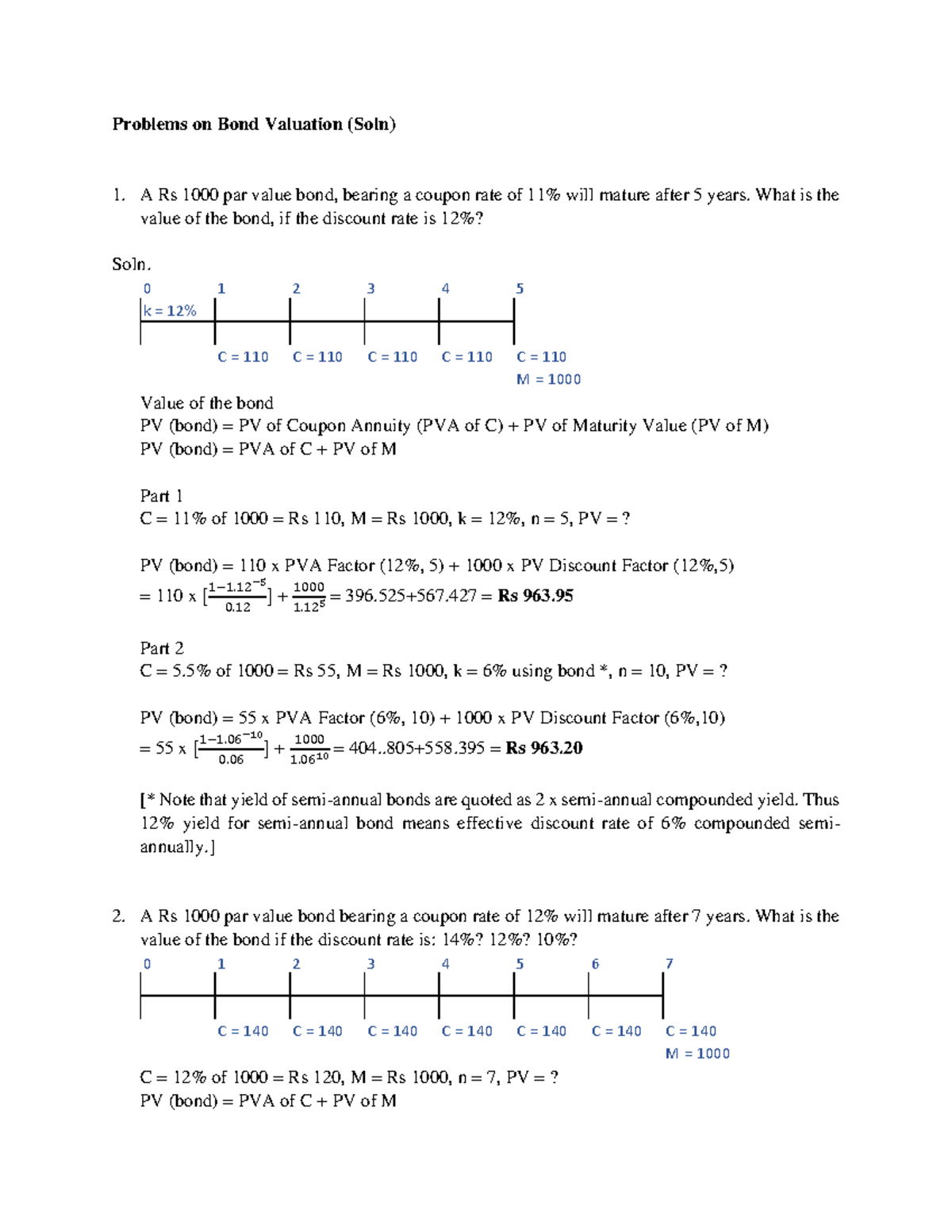

Bond Valuation Solutions Problems On Bond Valuation Soln A Rs 1000 Par Value Bond Bearing A Studocu

Pdf Problems And Solutions 1 Chapter 1 Problems Nur Syahirah Abdul Rahim Academia Edu

Chapter 6 Interest Rates And Bond Valuation Pdf Free Download

Chapter 6 Interest Rates And Bond Valuation Pdf Free Download

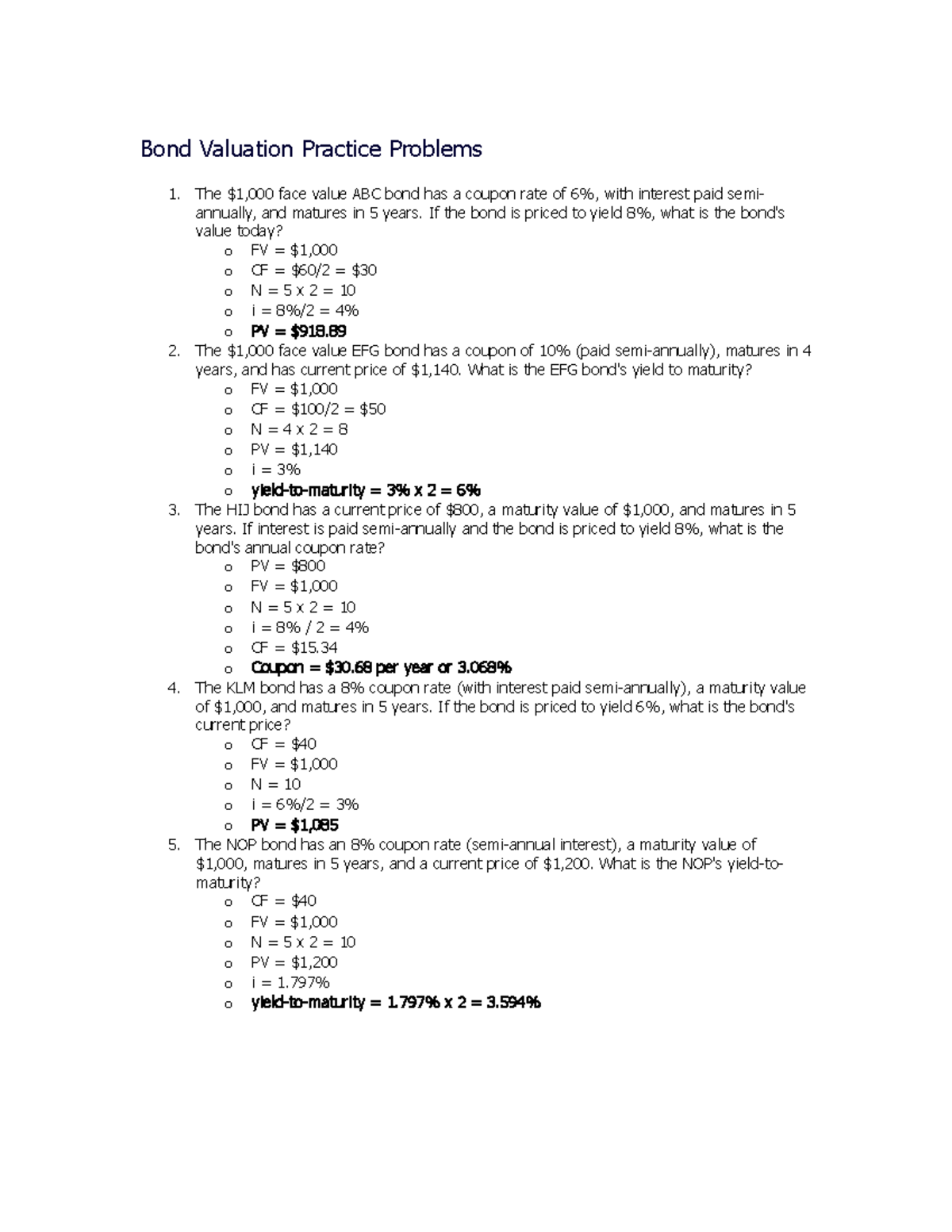

Bonds Bond Valuation Practice Problems The 1 000 Face Value Abc Bond Has A Coupon Rate Of 6 Studocu

Comments

Post a Comment